Are you sitting on extra undeveloped land? Putting it into a land conservation easement could earn you substantial tax savings. However, the process involves multiple steps and third parties. Fortunately, this land conservation easement guide can answer most of your questions.

What is a Conservation Easement?

A land conservation easement represents an agreement between a landowner and a government agency or property trust that limits development on a parcel of land. Usually, the landowner loses the right to build on their property. However, they can still farm it and enjoy it in noninvasive ways. In exchange for the land conservation easement, landowners typically enjoy significant tax breaks.

Land conservation easements are legally binding and permanent. The agreement is intended to conserve the undersigned land. Landowners voluntarily enter into these agreements for a variety of reasons, including improving water quality, nature preservation, and tax savings.

Does the IRS Offer a Conservation Easement Tax Deduction?

US tax authorities introduced tax deductions for land conservation easements on a temporary basis in 2006. However, regulators strengthened the rules and made them permanent in 2015. Today, taxpayers with land conservation easements enjoy substantial write-offs.

Current regulations allow qualifying property owners to deduct 50% of their annual income for up to 15 years. If the property owner is a farmer or rancher, it gets even better. Farmers and ranchers can deduct 100% of their annual income over the same time period.

However, the deductions have limits. Your deductions can’t exceed the appraised value of the land included in the conservation easement.

States with Land Conservation Eas

In addition to the federal benefits, 16 states offer tax incentives for land conservation easements. These states include:

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Iowa

- Maryland

- Massachusetts

- Mississippi

- New Mexico

- New York

- South Carolina

- Virginia

How Much Does a Conservation Easement Reduce Property Value?

Landowners entering into a land easement relinquish some of their ownership rights for the undersigned land in perpetuity. The conservation easement permanently attaches to the property regardless of any ownership changes. Consequently, the property and the conservation easement become a package deal for any would-be buyers.

Most people have a clear-cut purpose for purchasing land. As a result, a land conservation easement often makes property much less attractive to potential buyers. The easements significantly limit use of the property, and many home shoppers avoid them as a result.

Studies estimate conservation easements can reduce a property’s value by anywhere from 35% to 65%. So, anyone considering purchasing eased land should do an exhaustive cost-benefit analysis before buying. The tax benefits are certainly significant, but the declines in property value could negate the deductions entirely.

Furthermore, land easements can make it much harder to sell your property. Many buyers won’t even consider buying land with an easement, so it drastically reduces the addressable market for your property.

As you can see, entering into an easement could have long-reaching financial consequences, and you shouldn’t take the decision lightly. Always consult with professional financial, legal, and tax advisors before entering into an easement.

What is a Syndicated Conservation Easement?

A syndicated conservation easement is a passthrough entity that purchases property, enters into easements, and passes the tax benefits along to investors. The IRS recently began targeting these arrangements with the belief they’re primarily used as tax evasion vehicles, and the resultant regulatory scrutiny has put syndicated conservation easements on shaky ground.

Syndicated easements often provide excellent benefits for investors because the tax benefits usually outweighs the fees they pay to participate. However, a few years ago, the IRS began characterizing such arrangements as “listed” transactions. The classification will make it difficult for syndicated conservation easements to conduct business without encountering significant regulatory and compliance hurdles.

Syndicated conservation easements might sound attractive, but they could get you into trouble. We don’t advise participating in these shady deals, and you should be very careful if you choose to disregard that advice.

How to Get a Land Easement for Your Property

Forming a land conservation easement is a complex, multifaceted process. Here’s a brief step-by-step breakdown.

1. Get a Suitable Property

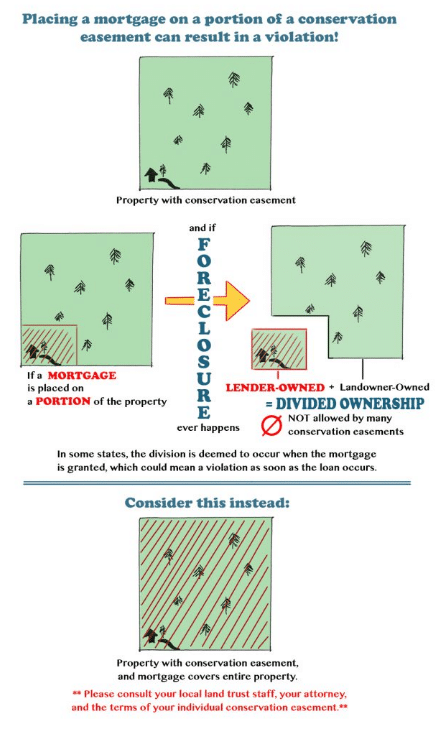

First, you need to own a piece of land to donate. Pre-existing mortgages on conservation easement properties are not expressly forbidden, but they can significantly complicate the process. If you’re willing to jump through the hopes, you might be able to form an easement with a property carrying a pre-existing mortgage.

However, many easement agreements limit or completely ban splitting the property into smaller parcels. As a result if this stipulation, a foreclosure could violate these restrictions if the lien is only placed on a portion of the property.

Important Notes on Pre-Existing Mortgages

If you plan on using your easement as a charitable deduction for tax purposes, tax law requires the permanence of the easement must not be threatened by a potential foreclosure. However, there are two ways you can get around this rule.

Your first option is to pay off the property and refinance with a new mortgage after the easement is formed. Taking this route puts the easement holder’s interests above the mortgage holder’s and eliminates the risk of a default-related property division.

Secondly, you can contact your mortgage holder and work out a deal that allows the easement to remain intact in the event of a foreclosure. If you decide to go this way, your must secure some or all of these provisions depending on the circumstances:

- Consent: You must secure the mortgage holder’s consent to the easement.

- Non-Disturbance: The mortgage holder must agree not to disturb the easement in the event of a sale, default, or bankruptcy.

- Subordination: Mortgage holder agrees that the easement holder’s rights under the easement take precedence over the its rights under the mortgage.

Securing these three elements might be difficult or impossible, but you need all three elements if you want to use your easement for charitable tax deductions.

2. Find an Easement Entity

You must donate your property to a government organization, property trust or other qualified entity to complete your easement. However, you should carefully weigh your options before you make a decision because you’re going to be stuck with your choice for as long as you own the property. Always try to find a group that aligns with your views and purposes for donating the property.

3. Complete the Necessary Legal Filings

Last but not least, you need to file the necessary forms. This process typically requires a lawyer and an appraiser. Once you get to this step, the professionals will take care of the rest. When your easement is complete, you can start taking advantage of the tax benefits we’ve outlined in this article.

How to Remove a Conservation Easement from Your Property

Removing a land conservation easement is no easy task. Easements are designed to remain intact in perpetuity, so regulations make it very difficult to pull out of the arrangement.

However, it’s possible to escape an easement with an extinguishment, transfer, or amendment.

You can learn more about these approaches in this report from Probate & Property.

Regardless of which route you chooose, the local courts are involved, and they will likely try to ensure the property or its proceeds are used in a way that’s as close to the original conservation purpose as possible.

Land Conservation Easements: Closing Thoughts

Land conservation easements incentivize landowners to conserve natural resources with a substantial tax benefit. These arrangements can significantly reduce your tax burden, but there’s no such thing as a free lunch. Easements typically provoke steep declines in property value, so anyone considering donating to a land conservation easement should consult with qualified professionals.