Identify theft is running wild in the US, and tax returns are a prime target for bad actors. To combat this issue, the IRS started assigning IRS identity protection pins in January of 2011. These six-digit numbers protect taxpayers’ identity and make it easier for the IRS to process your return.

What is an IRS Identity Protection PIN?

An IRS identity protection PIN is a six-digit number that protects you against tax fraud. The pin prevents unauthorized parties from filing a federal tax return with your SSN or TIN. You and the IRS are the only ones who can access your pin.

Why Do I Need an IRS IP PIN?

Identity theft can have long-lasting consequences. Once an identity thief gets access to your SSN or other personal information, they can file a tax return in your name and take your refund. However, an IRS identity protection pin makes this type of fraud almost impossible.

Your IRS IP PIN verifies your return’s authenticity, and thieves can’t access it.

How to Get an IRS IP PIN

Now that you understand the importance and benefits of having an IRS IP PIN, it’s crucial that you understand how to obtain one. Before you begin the process, there are a couple of things that you should understand. First of all, there is a rigorous process that you will be required to go through. This process is put in place to ensure that you are who you claim to be and that the IRS is issuing the right person their identity protection PIN number. It’s also important to note that spouses and dependents are eligible to receive an IRS IP pin number, as long as they are able to pass the identity verification process.

Gather Your Information

In order to receive an IP PIN number from the IRS, you will be required to provide certain information. Applicants seeking a PIN will need to provide either a Social Security number or a Taxpayer Identification Number. Additionally, you will need to provide a working phone number, a valid mailing address, and your latest tax returns. If there are any questions about your identity, the IRS may require more identifying information.

Go to the IRS Website

Using the IRS website is the easiest way to get an IRS IP pin. Use this online IRS PIN tool to get your PIN.

You can use the IRS IP pin tool between mid-January and mid-November. Once you complete the necessary steps, you will get your IRS IP pin right away.

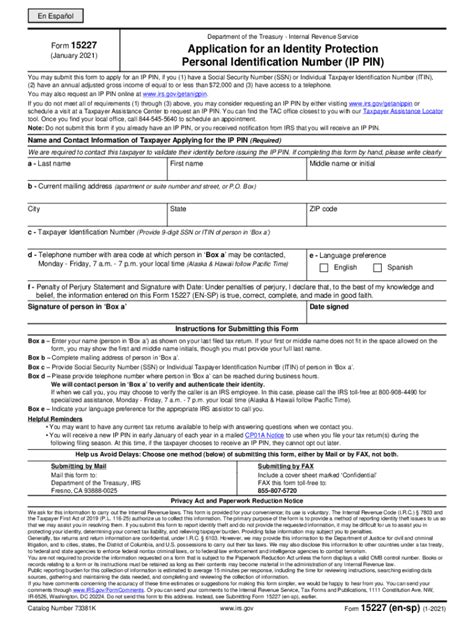

Fill Out IRS Form 15227

If you don’t want to get your IRS IP PIN online, you can also apply by mail. However, you can only use the mail-in option if your annual income exceeds $72,000.

If you meet those requirements, you can request a copy of IRS Form 15227. You’ll need a valid Social Security number or Taxpayer Identification Number and access to a telephone to get started. Follow the form’s instructions and call the specified phone number to get your PIN.

Submit IRS Form 15227

Once your Form 15227 is complete, you must submit it to the IRS. You can either mail or fax your completed form using the contact info.

Alternatively, you can make an appointment for an in-person meeting at a local Taxpayer Assistance Center.

Get Your IRS Identity Protection PIN

Once you have applied for your IRS Identity Protection PIN, the IRS will verify the information contained in your application. Depending on the method that you used to apply for your PIN, you may receive it in three different ways. Applicants who use the online tool immediately receive their IP pin numbers.

If you don’t use the online option, you can expect your IRS identity protection pin to arrive by mail the following year. This practice ensures the number stays confidential. Bad actors won’t have an opportunity to access it.

Finally, taxpayers applying for their IRS Pin in person will get their PIN in the mail within three weeks.

Important Notes About IRS IP PIN Numbers

- IRS IP PIN Numbers help prevent identity theft and expedite the IRS’s income tax processing.

- There are three ways to apply: Online, IRS Form 15227, and in-person at a Taxpayer Assistance Center.

- Depending on the method that you choose, you can receive your IP Pin number immediately, or within the following tax year.

- Applying for your IRS IP PIN online is the quickest way to go about it, as you will receive your PIN immediately.

- The IRS IP Pin number that you receive is valid for 12 months from the date that you receive it.

- The IRS generates a new IP PIN for you every year.

- When you log into the IRS website to get a new IP PIN tool, the website displays your current PIN number.

- Once you receive your IRS PIN, you must use it any time you file federal income tax.

More Tax Prep Tips

Follow the Shared Economy Tax blog for more helpful tax tips like these. If you’re interested in getting professional tax prep help for your business, we can help. Click here to set up a one-on-one strategy session with a Shared Economy Tax pro now.