Tax deadlines can cause a lot of anxiety, especially for small business owners and independent contractors. Fortunately, you have some options if you think you will miss the deadline. In this post, I’ll explain what steps you can take to minimize the negative consequences if you get stuck filing taxes late.

When is the Tax Deadline?

Typically, the tax deadline falls on April 15. However, the 15th falls on a weekend or holiday some years, so the deadline gets moved back to the next business day. In these cases, the deadline can fall on the 16th, 17th, or even 18th. Check this year’s calendar to be certain of the deadline date.

In special circumstances, the IRS will sometimes postpone the filing deadline entirely. For example, in 2020, the government pushed the tax deadline back to July 15 as a result of the COVID-19 pandemic, giving taxpayers three additional months to file taxes and pay their taxes.

Sometimes, taxpayers affected by natural disasters will receive extensions that won’t apply to the entire country. For example, the IRS offered extensions to certain taxpayers as a result of storms and flooding in California in early 2024. Unlike the COVID-19 tax relief measures, this extension only applied to taxpayers living in areas impacted by the storms.

What If I Need More Time to Pay My Taxes?

If you think you’re going to file taxes late, you still have options. You can avoid penalties if you take proper precautions. If you are unable to pay by the tax deadline, it is important to set up a payment plan with the IRS before the deadline to avoid failure to pay penalties.

Filing a tax extension postpones the deadline to submit your return, but you still have to pay your tax bill on time. An extension only pushes back the filing deadline, so you’re still responsible for covering your annual tax bill before the April 15 deadline. However, the IRS will give you some wiggle room if you apply for a payment plan prior to the deadline.

What Happens if I Miss the Tax Deadline?

If you miss the tax deadline there are several things that can happen. The IRS has different penalties for improper filings and missed payments, and you could get hit with both if you miss the deadline completely.

Annual Taxes and Income Taxes

The IRS accesses a monthly 5% penalty for filing taxes late. The penalty cannot exceed 25% of the taxes due. If you fail to pay your taxes by the deadline, you will incur a 0.5% penalty for each month your tax payments are late.

SALT Taxes

In addition to federal income taxes, each state has its own rules regarding tax deadlines and penalties. Each state sets its own tax rules, so you will face different penalties depending on where you live. For example:

- California assesses a 5% penalty on unpaid taxes, plus an additional 0.5% for each month or partial month taxes go unpaid. The maximum penalty is 25% of the unpaid taxes.

- New York charges a penalty of 5% of the taxes owed for each month or partial month the taxes are late.

- New Jersey charges 5% of the taxes due for each month or part of the month the taxes are late. In addition, New Jersey may also tack on a $100 penalty each month if the taxes are late.

- Illinois charges a 2% late penalty on the balance for taxes that are under 31 days late. Payments that are over 31 days late are subject to a 10% on the balance due.

If you conduct business in multiple states, you should know about the tax laws in each state. Working with a SALT accounting specialist can help you plan for your state and local taxes.

Quarterly Tax Payments

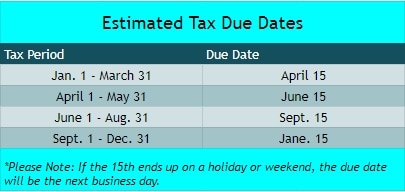

If you’re self-employed and owe more than $1,000 in taxes, you probably have to submit quarterly payments on your estimated taxes. Failure to pay could result in an 0.5% underpayment penalty each month you’re late. Quarterly taxes are typically due on April 15th for Q1, June 15th for Q2, September 15th for Q3, and January 15th of the following year for Q4.

Can a Tax Extension Buy Me More Time?

If you need more time to file your taxes, you can file an extension to postpone the deadline for filing your tax return to October 15. However, the extension only covers your return paperwork, not your payment, so you still need to pay your tax bill on time. Otherwise, the IRS will penalize you for missing the payment deadline, regardless of whether you requested an extension.

Payment Plans

If you need more time to pay, you can set a payment agreement with the IRS. You can choose from several types of plans, including short-term payment plans and installment agreements. If you can pay your tax bill within 120 days, a short-term plan is probably the best option. However, if you need more time you will need to set up an installment agreement.

Remember, you must request a payment plan BEFORE the tax deadline passes or you could still face late payment penalties.

Get Professional Tax Help Now

Don’t panic if you’re worried about filing taxes late. Our talented tax team can prepare your taxes quickly and accurately. We can also assist you with filing extensions and setting up payment agreements. Get started today with a one-on-one strategy with a Shared Economy Tax professional. You can also subscribe to our tax tips newsletter using the form below.