The average cost of an in-town move hovers around $2,000, while relocating across the country can approach $30,000. Because moving is often tied to job changes, many taxpayers wonder whether they can write off these substantial expenses. In this post, we’ll break down the current rules on deducting moving expenses in 2025 and explore how things might change in the near future.

Can I Deduct Moving Expenses?

It’s a straightforward question with a layered answer. Under current law, most taxpayers are not eligible to deduct moving expenses. That’s because the Tax Cuts and Jobs Act (TCJA) suspended the moving expense deduction for non-military taxpayers beginning in 2018—and that suspension remains in effect for the 2025 tax year.

However, there’s one major exception: active-duty military members who relocate due to a permanent change of station can still deduct unreimbursed moving expenses. This includes expenses associated with relocating both the service member and their family.

Looking ahead, the TCJA’s individual tax provisions are scheduled to expire after 2025. If Congress allows the expiration to proceed without renewal or replacement, the moving deduction could return in 2026 under the rules that existed prior to the TCJA.

Previous Requirements for Deducting Moving Expenses

Before the TCJA, taxpayers could deduct moving expenses if certain conditions were met:

- Your employer did not reimburse your moving expenses with pre-tax funds.

- Your new job location was at least 50 miles farther from your old home than your previous job location.

- You worked full-time for at least 39 weeks during the 12 months following your move.

Importantly, this was considered an “above-the-line” deduction, meaning you could claim it even if you didn’t itemize your deductions.

If the deduction is reinstated in 2026, it remains to be seen whether it will follow these same guidelines or come back in a modified form.

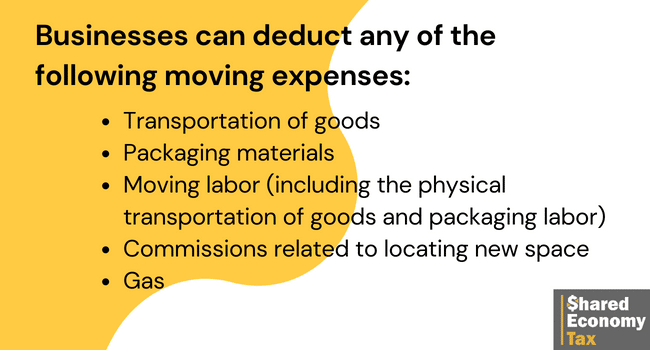

Can Businesses Still Deduct Moving Expenses?

Yes—businesses can still fully deduct the cost of relocating a company. This includes corporations, LLCs, and other business entities—but not sole proprietors filing Schedule C on their individual return.

Unlike individual taxpayers, businesses don’t need to meet any distance or purpose requirements to claim a deduction. The expenses simply need to be ordinary and necessary for the business. Deductible moving expenses for businesses can include:

- Transportation of inventory, equipment, and office supplies

- Packing and shipping costs

- Labor for movers or internal relocation support

- Gas or mileage for vehicles used during the move

- Real estate commissions or broker fees tied to the relocation

Businesses can deduct these costs directly on their income tax returns—no separate forms required.

Are There Any Exceptions?

For now, the only exception for deducting personal moving expenses is reserved for active-duty military personnel who are moving due to a permanent change of station. Even then, the IRS only allows deductions for expenses deemed “reasonable” under the circumstances.

These may include:

- Travel and lodging expenses during the move

- Gas costs (or mileage using the IRS moving rate, which remains $0.22/mile for 2025)

- Temporary storage of household items

- Insurance related to the move

- Professional moving services

If the service member is reimbursed for any of these costs by the military, only the unreimbursed portion is eligible for a deduction.

What is IRS Form 3903 and When Do You Need It?

IRS Form 3903 is the official form used to report deductible moving expenses when filing your federal tax return. However, due to changes introduced by theTCJA, this form is currently only used by active-duty members of the U.S. Armed Forces who relocate due to a permanent change of station.

If you’re in the military and qualify under this exception, Form 3903 allows you to deduct unreimbursed moving expenses related to transporting your household goods and family members. These deductions are considered “above-the-line,”meaning they reduce your taxable income even if you don’t itemize deductions.

To properly complete Form 3903, you’ll need to gather:

- The total cost of moving household goods (e.g., movers, storage)

- Travel expenses for yourself and family (excluding meals)

- Any reimbursements from your employer not included as income

For everyone else, Form 3903 has been effectively suspended from use until at least 2026, when the TCJA provisions are scheduled to sunset. If Congress allows those changes to expire without replacement legislation, non-military taxpayers may once again become eligible to claim moving expenses, potentially reinstating Form 3903 as a standard part of individual tax filings.

Until then, military members only need to worry about this form—and they should ensure it’s completed accurately to maximize eligible deductions.

Closing Thoughts on Moving Deductions

Moving can be expensive, and before 2018, many Americans were able to soften the blow with a federal tax deduction. Today, options to deduct moving expenses are almost entirely gone for individual taxpayers unless they are active-duty military. Businesses, on the other hand, still enjoy full deductibility of moving-related expenses when relocating a company or office.

As we move through 2025, the bigger question is what happens next. If the TCJA provisions expire without replacement, we could see a return of the moving deduction for non-military individuals starting in 2026. Until then, it’s unlikely that many taxpayers will benefit from claiming moving expenses on their 2025 return.

Wondering how a move could impact your tax situation? Our team can walk you through the current rules and help you evaluate your options before you commit. Get started now with a one-on-one strategy session to see how much you can save.