When you start a business, especially in the sharing economy (think Uber, Airbnb, and other gig economy ventures), choosing the right business structure is crucial. Your choice affects everything from taxes to liability, and it’s not a decision to be taken lightly. In this updated post, we’ll guide you through the options and help you choose the best structure for your sharing economy business.

What is a Business Entity?

A business entity, or structure, defines how your business operates in the eyes of the law. It sets the rules for ownership, taxes, liability, and management. Most importantly, choosing the right entity separates your personal finances from your business, protecting your personal assets from business liabilities.

In the sharing economy, the right business structure can help you save on taxes and protect your assets, while the wrong one could expose you to unnecessary risks. Here’s a look at your options:

Common Business Structures for Sharing Economy Entrepreneurs

For sharing economy businesses—whether you’re a rideshare driver or an Airbnb host—you have a range of business structures to choose from. These include sole proprietorships, partnerships, LLCs, S-corporations, and C-corporations. Each structure has unique pros and cons that should be carefully considered based on your business’s size, risk, and tax needs.

Sole Proprietorship

A sole proprietorship is the simplest business structure. It’s ideal for those just starting out and for business owners with limited risk. In the context of the sharing economy, Uber drivers or freelancers may begin as sole proprietors, but this structure offers no liability protection, meaning personal assets could be at risk if you’re sued.

- Tax Filing: You report your business income and expenses on Schedule C attached to your personal tax return.

- Liability: The biggest drawback is that there’s no separation between personal and business liabilities. If you face a lawsuit, your personal assets—such as your home or car—could be at risk.

Example:

A rideshare driver working part-time could easily start as a sole proprietor. This structure is simple, with minimal paperwork, but it might not be the best option as their business grows or their exposure to liability increases.

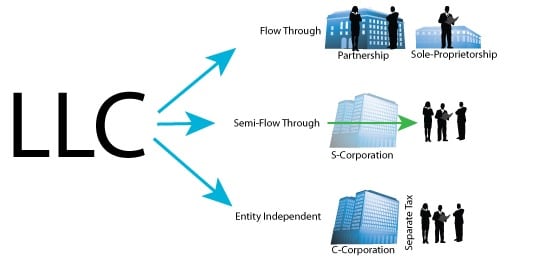

LLC (Limited Liability Company)

An LLC is one of the most popular options for sharing economy businesses. It combines the liability protection of a corporation with the simplicity of a partnership or sole proprietorship.

- Liability Protection: The LLC structure limits the owner’s personal liability. This means that your personal assets are protected in the event of a lawsuit.

- Tax Flexibility: LLCs offer several tax options. By default, an LLC is taxed as a pass-through entity, meaning business income passes through to the owners’ personal tax returns. Alternatively, LLCs can elect to be taxed as an S-corp or C-corp.

Example:

If you operate multiple Airbnb rentals or freelance in a highly litigious field, forming an LLC will protect your personal assets while offering tax flexibility. An LLC could also be an excellent choice for an Uber driver who wants to separate their personal finances and limit personal liability.

S-Corp (S Corporation)

An S-Corp is a tax designation that allows income to pass through to the business owner’s personal tax return, avoiding the double taxation that applies to C-Corps. It can be beneficial for businesses that generate a significant amount of profit, but it comes with more complex requirements.

- Tax Benefits: S-corp owners can reduce self-employment taxes by paying themselves a “reasonable salary” and taking the rest of the profit as distributions, which are not subject to payroll taxes.

- Owner Limitations: An S-corp can only have 100 shareholders, and all must be U.S. citizens or residents.

- Simplicity: While more complex than an LLC, S-corps can provide valuable tax savings for businesses with consistent income and a need for payroll.

Example:

If you’re an Airbnb host with several properties or an Uber driver making over a certain threshold (typically $50,000+ in net income), electing to be taxed as an S-corp might save you money by reducing self-employment taxes.

State Pass-Through Entity Taxes (SALT Workaround)

Since the SALT cap was introduced by the Tax Cuts and Jobs Act in 2017, individuals can only deduct $10,000 in combined state and local taxes. However, states have implemented pass-through entity (PTE) taxes as a workaround.

- SALT Workaround: Certain states, including California, New York, and New Jersey, allow pass-through entities (LLCs, S-corps) to pay the state taxes at the entity level, bypassing the $10,000 SALT cap.

- Tax Savings: This means sharing economy entrepreneurs, such as rideshare drivers and Airbnb hosts, can avoid the SALT cap by electing PTE taxation.

Example:

A rideshare driver in New York with an LLC or S-corp could benefit from paying state income taxes at the business entity level, ensuring their SALT deduction exceeds the $10,000 cap that would otherwise apply to individual tax returns.

C-Corp (C Corporation)

A C-corp is more suited for larger businesses, particularly those with plans for public offering or significant external investors.

- Double Taxation: C-corps are taxed separately from the owners, meaning profits are taxed at the corporate level, and shareholders are taxed again when they receive dividends.

- Flexible Ownership: Unlike S-corps, C-corps can have an unlimited number of shareholders, including foreign investors.

- Attractive for Investors: C-corps can issue multiple classes of stock and have more flexibility in raising capital.

Example:

A large-scale car-sharing business or a platform-based app that involves multiple investors and substantial capital might opt for a C-corp structure to attract investors and plan for future public listing.

What’s the Right Entity for Your Sharing Economy Business?

Choosing the right business entity depends on several factors, such as your income level, liability risk, and long-term goals. For sharing economy businesses, some of the most common options include:

- LLC for Airbnb hosts with a few properties or Uber drivers who want liability protection and tax flexibility.

- S-corp for higher-earning rideshare drivers or Airbnb hosts looking to reduce self-employment taxes.

- LLC with state PTE taxes in high-tax states to bypass SALT caps.

Tax Law Changes for 2025 and How They Affect You

- Qualified Business Income (QBI) Deduction: If you operate your business through an LLC or S-corp, you may be eligible for the QBI deduction, which allows you to deduct up to 20% of qualified business income. However, higher-income earners may face restrictions.

- SALT Cap Expiration: As previously mentioned, the SALT cap is set to expire at the end of 2025, meaning you could benefit from unlimited SALT deductions if you elect the right entity structure for your state. However, negotiations to renew the cap are currently underway. Check our post on SALT deductions for the latest updates.

Closing Thoughts: Tailoring Your Business Structure to Your Needs

Choosing the right entity structure is a crucial decision for sharing economy businesses, and the tax landscape is constantly evolving. By considering liability protection, tax advantages, and state-specific strategies (like PTE taxes), you can make the most of your business structure and save on taxes.

At Shared Economy Tax, we specialize in helping Uber drivers, Airbnb hosts, and other sharing economy entrepreneurs choose the right entity structure and implement tax-saving strategies. Get started now with a one-on-one strategy session to make sure you’re on track for tax savings this year.