As we move deeper into the bonus depreciation phase out schedule, 2025 marks a critical turning point. Businesses can now deduct only 40% of the cost of qualifying assets placed in service this year — a sharp drop from the 100% deduction available just a few years ago. Bonus depreciation has long served as a powerful tool for small businesses looking to reduce taxable income and improve cash flow, but with this tax break on the way out, strategic planning is more important than ever.

In this guide, we’ll walk through what bonus depreciation is, how the rules are changing in 2025, and what business owners can do to make the most of the remaining opportunities — including a look at possible extensions being considered under new legislation.

What is Bonus Depreciation?

Bonus depreciation allows businesses to write off a large portion of qualifying asset purchases in the year the asset is placed into service. Traditionally, businesses must depreciate the cost of equipment and property over multiple years, but bonus depreciation accelerates this tax benefit, helping businesses recoup their investment faster.

This provision has played a major role in stimulating business investment since it was expanded under the 2017 Tax Cuts and Jobs Act (TCJA). While Section 179 also allows for upfront expensing, bonus depreciation has fewer limitations and can apply to used property as well, making it especially attractive to small businesses.

What are the Qualifications for Bonus Depreciation?

To claim bonus depreciation, several requirements must be met:

- The asset must be placed into service during the year for which you’re claiming the deduction.

- It must have a recovery period of 20 years or less under MACRS.

- The asset must be “new to you”—you can buy it used, but you can’t have owned or used it personally beforehand.

- The asset must be for business use—not mixed-use or personal use.

It’s important to note that residential rental property and commercial real estate do not qualify, and different types of assets may require specific depreciation schedules. Furthermore, any asset you already own and convert to business use does not meet the “new-to-you” test.

What is the Current Status of Bonus Depreciation in 2025?

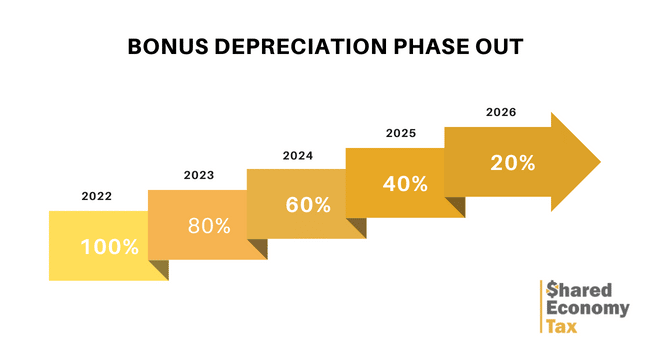

As of 2025, the bonus depreciation percentage has dropped to 40% for qualified property placed in service during the tax year. This continues the phase-out schedule set in motion by the TCJA.

Previously, the deduction allowed 100% expensing from late 2017 through the end of 2022. However, starting in 2023, the deduction began to decrease by 20% each year:

- 2023: 80%

- 2024: 60%

- 2025: 40%

- 2026: 20%

- 2027 and beyond: 0% (unless extended by Congress)

This gradual reduction significantly affects planning for major asset purchases, especially for industries with high equipment needs.

Legislative Outlook for Bonus Depreciation Extension

While the scheduled phase-out remains in place for 2025, there is growing bipartisan support for restoring 100% bonus depreciation—possibly even retroactively. The most prominent effort is centered around the “Big Beautiful Bill”, a sweeping tax package introduced in 2024.

The BBB includes a provision to extend 100% bonus depreciation through at least 2026, with optional retroactivity to tax year 2024. As of mid-2025, the bill remains in committee and has not yet passed. Its outlook is uncertain due to budgetary concerns and competing tax priorities, but its bonus depreciation provision is one of the most broadly supported elements.

Many tax professionals and business advocacy groups are urging clients to plan based on current law, but also stay flexible. If the BBB—or a similar measure—passes in late 2025 or early 2026, it could reopen full bonus depreciation for last year’s or this year’s purchases. Until then, businesses should operate on the assumption that the 40% rule applies.

How Can I Use Bonus Depreciation Before It Ends?

To take full advantage of the remaining bonus depreciation benefit in 2025, here are a few strategies:

Make large purchases before year-end: Ensure qualifying assets are not just purchased, but placed into service by December 31, 2025. This is critical, as only in-service assets qualify for that year’s bonus percentage.

Label eligible assets properly: When filing your tax return, work with your CPA to ensure assets eligible for bonus depreciation are appropriately categorized in your depreciation schedules and forms (e.g., Form 4562).

Accelerate future purchases: Consider moving 2026–2027 planned purchases forward into 2025 to capture the 40% deduction, rather than waiting and settling for 20% or nothing.

Remember, bonus depreciation is automatic unless you elect out of it, unlike Section 179, which must be elected specifically.

Bonus Depreciation Phase Out FAQs

These are some of the most common questions we’ve been receiving from clients regarding the bonus depreciation and its phase-out schedule.

Will this phase-out affect new properties only?

No. The phase-out applies to both new and used property, provided the asset is new to the taxpayer.

Will the same qualifications be in place during the phase-out?

Yes. The existing eligibility rules continue to apply through each phase-out year unless changed by legislation.

Is the bonus depreciation phase-out permanent?

Under current law, yes. The full deduction will sunset in 2027 unless Congress passes new legislation like the BBB to extend it.

Why is it being phased out?

The 100% bonus depreciation was always intended as a temporary stimulus measure under the TCJA. The phase-out was built in to limit its long-term fiscal impact.

Is there an alternative?

Yes. Section 179 remains available, allowing businesses to expense up to $1.22 million (2025 indexed limit) of qualifying assets, with a phase-out threshold of $3.05 million. Section 179 also offers more flexibility in how much of the asset cost to deduct up front.

Final Thoughts on the Bonus Depreciation Phase Out

The window for bonus depreciation is narrowing. In 2025, you can still deduct 40% of qualified asset costs—but that drops to just 20% next year and disappears altogether in 2027 unless extended. President Trump’s “Big Beautiful Bill” could change this, but it’s still being negotiated in the Senate at the time of writing. We will update this article once any new provisions are finalized.

For now, the safest strategy is to make eligible purchases and place them into service before year-end to secure the 40% deduction. While the Big Beautiful Bill could bring welcome relief, relying on Congress to act is risky.

Need help strategizing your end-of-year purchases or evaluating depreciation options? Shared Economy Tax’s team of expert tax professionals can help you navigate bonus depreciation, Section 179, and other advanced strategies to maximize savings. Get started today with a one-on-one strategy session to see how much you can save.