Looking for a way to do a little good and lower your tax obligation? Have you heard of Opportunity Zones? The Opportunity Zones Program is a lesser known part of the Tax Cuts and Jobs Act that was passed in 2017. While everyone was paying attention to the cuts themselves, the Opportunity Zones Program slid under the radar, but now it is gaining again traction.

The Opportunity Zones Program offers a way for investors to reinvest capital gains into disadvantaged communities in exchange for tax benefits. And it is something that our sophisticated investor clients are very familiar with. Not sure how this do good credit can do good for your real estate business? Allow us to explain.

The Do Good Credit

The Opportunity Zone Program was designed to be beneficial for both poorer communities (Opportunity Zones) and investors. It provides some much needed economic relief to areas that have been forgotten or left behind, while at the same time providing a vehicle for investors to escape some of their tax burden. In exchange for reinvesting capital gains into a Qualified Opportunity Fund (QOF), real estate investors can enjoy 1 of 3 benefits:

- A temporary deferral of inclusion in income for capital gains that are reinvested.

- A step up basis of capital gains.

- Permanent exclusion of income in capital gains if the investment is held for 10 years.

This do good credit allows you to do good in communities that are economically disadvantaged, while allowing you to defer capital gains in other investments. There is no limit to how much you can invest, how much tax you can avoid, the type of taxes you can avoid (for most states), and no limit on how long the proceeds can compound tax free. The big value is that you can take capital gains from any investments, including stocks, and move them into OZ qualified areas.

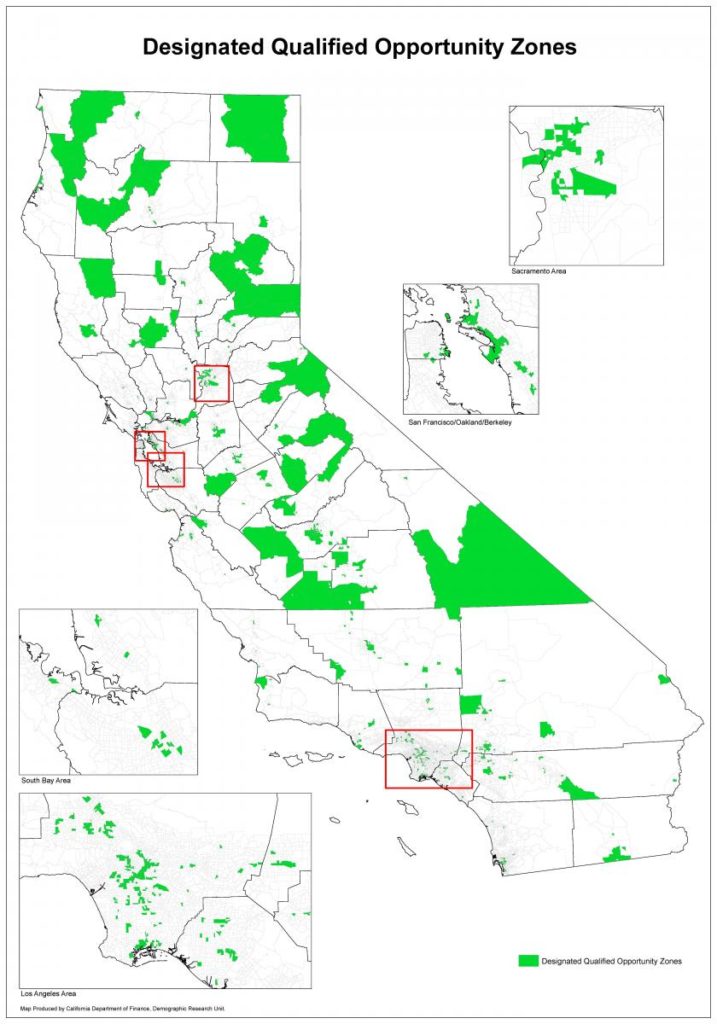

What Are Opportunity Zones

Opportunity Zones are communities that are economically challenged. These are poorer communities in both urban and rural areas. They are appointed by the State and approved by the Secretary of The US Treasury. In order to qualify as an Opportunity Zone a community must meet certain requirements:

- Have a poverty rate of 20% or higher

- A median household income of no more than 80% of the statewide median household income for communities in non-metropolitan areas.

- A median household income of no more than 80% of the greater state median household income or the overall metropolitan median household income for communities in metropolitan areas.

- Be an adjacent community to an existing Opportunity Zone with a median household income no greater than 125% of the median household income of the nearby Opportunity Zone.

Opportunity Zones have been established in all 50 states. There are currently over 8,700 communities that qualify.

Opportunity Zones That Have Reaped The Benefits of This Do Good Credit

The goal of the Opportunity Zones Program is to have a positive impact on the community. With that being said, there are some restrictions on industries. For example, no vice businesses like liquor stores, casinos, or massage parlors. In addition, golf courses and country clubs are also excluded.

Of course, as an investor you will want to invest your money in areas that are seeing a positive impact. To measure the success of an Opportunity Zone a study conducted by Webster Pacific, analyzed the growth in income in these areas. Of the 8,700 Opportunity Zones, 22 of them saw an increase in households earning $200,000. Wealth is directly correlated to the real estate value in an area, so by measuring to growth in income, you can see which Opportunity Zones are performing the best. A couple of the best performing Opportunity Zones are located in:

- Kings County, New York

- Vanderburgh, Indiana

- Oklahoma County, Oklahoma

- District of Columbia

- Los Angeles, California

- New York County, New York

- Fairfield County, Connecticut

- Alameda County, California

Interested in learning more about how this do good credit can do good for your real estate business? Looking to do a deal soon and need a real-time advisor? Or just looking to keep up to date with tax credit opportunities? Contact the tax experts at Shared Economy or subscribe to our newsletter below.

Related Articles

Tax Preparation For Peer-To-Peer Car Sharing Turo & Getaround

Selecting an App to Track Business Time

Should I Be Paying Quarterly Taxes for My Business?