In estate planning, one effective way to minimize taxes is through a Qualified Personal Residence Trust (QPRT). This trust offers a chance to reduce the taxes owed on your home, making it a valuable tool in tax-saving strategies for your estate plan.

What is a Qualified Personal Residence Trust [QPRT]?

A Qualified Personal Residence Trust is an irrevocable trust allowing homeowners to transfer their vacation home or primary residence into the trust. This transfer is done while retaining the right to live in the property. The main advantage here is the potential reduction of gift tax when the property eventually passes to a beneficiary.

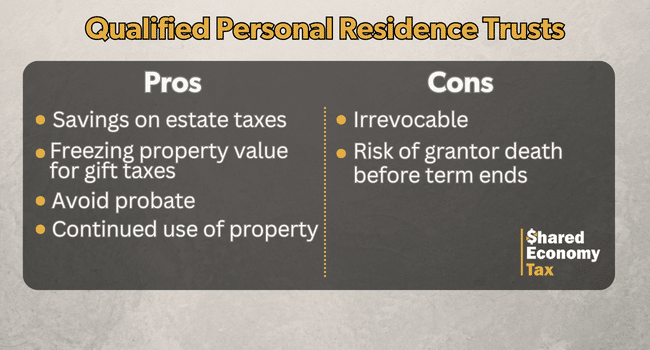

When a homeowner establishes a QPRT, they maintain “retained interest” in the property. This period of retained interest eventually ends. When it does, the remaining interest in the property is passed on to the beneficiaries. While QPRTs offer significant tax savings, the permanent nature of an irrevocable trust also carries certain risks. It’s important to understand both the advantages and potential downsides before establishing a QPRT.

Benefits of a Qualified Personal Residence Trust

The primary benefit of creating a QPRT is the potential reduction of estate taxes. By transferring your home into the trust, you effectively lower the total value of your estate by the home’s value. This move can significantly reduce the estate taxes that your beneficiaries might otherwise have to pay.

Moreover, using a QPRT allows the grantor to freeze the value of the property for gift tax purposes at the time of transfer into the trust. Even if the property’s value appreciates significantly over time, its value for tax purposes remains locked in at the time of the initial transfer. This means that when the home eventually does pass to the trust’s beneficiaries, it does so at a potentially much lower tax cost than if it were part of the grantor’s estate at death.

Much Does a QPRT Cost?

Establishing a QPRT involves several important steps:

- Consult with an estate attorney and a Certified Public Accountant (CPA) to discuss your situation and the feasibility of a QPRT in your estate plan.

- Review and sign the trust document that formally opens the QPRT.

- Determine the gift value of your home, which requires knowing the home’s fair market value.

- Transfer the title of your home to the trust.

- File a gift tax return at the end of the year, reflecting the transfer into the trust.

Grantors and Beneficiaries in QPRTs

In a QPRT, the person who creates the trust is the grantor. The beneficiaries are those who will inherit the trust after the grantor’s death. For instance, if you wish your children to inherit your home, but worry about the potential estate taxes on its value, a QPRT can be a strategic solution.

Consider a scenario where your home is currently valued at $1 million, and you set up a QPRT with a 10-year duration. If, over the next decade, your home’s value increases by $400,000, this appreciation is essentially tax-free within the QPRT. The home’s transfer to the beneficiaries will be taxed based on the initial $1 million valuation, not its appreciated value.

Duration and Terms of QPRTs

A QPRT does not have a fixed duration, but the grantor sets a term for their retained interest. Once this term expires, the remaining interest in the home passes to the beneficiaries. If the grantor is still alive at this point, they can arrange to rent the property from the beneficiaries at the current market rate.

Should the property cease to be used as a personal residence, the nature of the trust could change, potentially converting into a different type of trust, such as a Grantor Retained Annuity Trust (GRAT).

QPRTs for Airbnb Hosts

For those who own a primary or secondary home used for Airbnb hosting, a QPRT can offer significant benefits. During the period when you retain interest in the home, you can use it as you see fit, including as a short-term rental. However, local regulations applicable to all Airbnb properties still apply. It’s important to note that you can have only two QPRTs active at one time, including one for a primary residence and one for a secondary residence.

Risks and Considerations of QPRTs

While QPRTs offer tax advantages, they are not without risks and potential downsides. If the grantor dies before the end of the retained interest period, the property may revert to the estate. Additionally, changes in tax laws could impact the trust. It’s also important to remember that once a QPRT is established, it is irrevocable and cannot be altered or canceled.

Is a QPRT Right for You?

Deciding whether a QPRT is appropriate for you depends on your individual circumstances and estate planning goals. Consider the potential benefits against the permanency and irrevocability of the trust. While a QPRT can significantly reduce estate taxes, this only occurs if you outlive the retained interest period. If you pass away before the property transfers to the beneficiaries, it becomes part of your taxable estate again.

Setting Up a QPRT the Right Way

Creating a QPRT is a complex legal and financial undertaking. It’s advisable to work with professionals, such as tax experts or estate planning attorneys, to ensure that your QPRT is set up correctly and aligns with your estate planning objectives.

Closing Thoughts

A Qualified Personal Residence Trust can be a powerful tool in estate planning, offering the ability to reduce estate taxes and freeze property value. However, given its complexities and permanent nature, professional advice is crucial in determining if a QPRT is suitable for your estate planning needs.