Taxes are an inevitable part of working. Regardless of how you earn your income, taxes must be paid on the income you earn. The tax filing deadline is quickly approaching. If you haven’t filed your taxes yet, now is a good time to start gathering the necessary documents. If you drive for Uber or work as an independent contractor, your tax scenario may be a little different. Make sure you have these Uber tax forms on hand before you start preparing your taxes.

Uber Tax Form Checklist

Before you sit down to file your taxes, you need to make sure you have all of the Uber tax forms you need. This also goes for drivers on Lyft and other rideshare platforms. It is a good idea to gather all of your Uber tax forms before you prepare your taxes. Scrambling at the last minute can lead to mistakes being made on your taxes, so make sure you have everything you need before you get started. Some things you may need to get started include:

- All wage and tax forms like W-2s worked as an employee

- Information returns like 1099’s if you earned independent contractor or self-employed income Detailed income statements like a P&L

- Receipts and expense tracking

- Information on dependents if you have any

- Mileage tracking

In addition to having the necessary documents to prepare your taxes, you should also have a plan for deductions and credits. A little bit of advance planning can make a big difference at tax time. Plus, it helps you stay organized throughout the year.

Uber Tax Forms: 1099 Forms

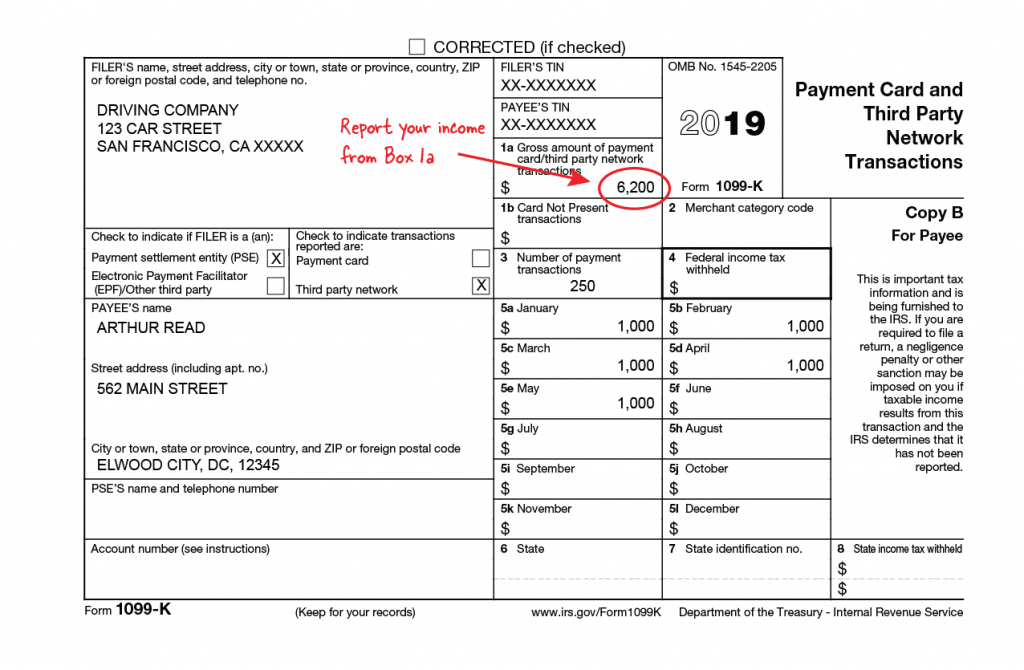

Ubers uses 1099 Forms to report driver income. You get one so you have a record of your earnings, and the IRS gets one so they’re aware of the income. Your 1099 form is the most important Uber tax form, so don’t ignore it.

If you receive an Uber 1099, use the totals on the form to fill out your taxes. If your numbers are off, the IRS could impose penalties and fees. Make sure you file accurately to avoid running into problems later.

Many drivers won’t receive a 1099 form from Uber because they don’t meet the minimum qualifications. Uber only issues 1099 forms for drivers that earn over $20,000 on more than 200 transactions. This form is called a 1099-K, but you probably won’t receive one unless you’re an active driver.

Sometimes Uber issues 1099 MISC forms, but they only do it for drivers that earned bonuses or referral fees. If you earned more than $600 from these sources, you will probably receive a 1099 MISC form.

Keep in mind, you must pay taxes regardless of whether you receive a 1099 form from Uber. It’s your responsibility to report all of your income. If you don’t receive a 1099 form, you have to calculate your earnings manually using the driver dashboard. Learn more here.

Expenses and Receipts

The IRS classifies Uber drivers as self-employed professionals. As a result, drivers can claim certain write-offs and deductions that traditional employees can’t. Uber drivers can deduct their expenses as long as they’re ordinary and necessary to their driving business. Some common examples of Uber deductions include:

- Standard mileage deduction

- Depreciation

- Office expenses

- Marketing

- Traveling

Make sure you properly categorize your business expenses and track receipts. You must have proof to back up your deductions in case the IRS has questions. Maintain your records for at least three years to ensure you stay in the clear.

Mileage Logs or Vehicle Expense Records

Uber drivers can also deduct costs associated with the business use of their vehicles. You can claim the standard mileage deduction for every business mile driven, or you can itemize your actual costs. You need to track business miles to claim either deduction, so you should keep mileage logs to ensure you have adequate records in the event of an IRS inquiry.

However, you will need to track expenses too if you plan to deduct actual costs. These expenses include:

- Car payments

- Registration costs

- Insurance costs

- Taxes

- Maintenance

- Repairs

- Parking fees

- Tolls

Records of Investments and Retirement Contributions

Drivers can deduct IRA contributions up to the maximum contribution limit of $6,000. You have until the previous year’s tax deadline to make contributions, so you have extra time to max out your IRA contributions after the tax year ends. If you’re searching for last-minute deductions, making a late IRA contribution is an excellent option. IRA contributions are an above-the-line deduction, so you can claim them without itemizing.

Additional Earnings: W2 and 1099 Forms

Many Uber drivers have multiple streams of income. If you receive a W2 and 1099 form, use both to calculate your gross annual income.

File Your Uber Taxes Now

Now that you have your Uber tax forms organized, it’s time to file! If you’re still not sure about how your Uber income will affect your taxes, talk to a professional tax advisor. Shared Economy Tax specializes in taxes for Sharing Economy workers, so we’re happy to answer your questions. Get started today with a one-on-one strategy session with one of our tax pros. It’s the best way to ensure you’re on the right track. You can also sign up for our complimentary tax tips newsletter using the form below for more Uber tax tips.