When you purchase a fixed asset, you can’t always take the total expense of the purchase at once. Instead, you’ll need to calculate the allowed depreciation (and the rules change each year) to figure out how much of the purchase you can expense each year. A depreciation schedule helps you calculate and track the depreciation expense each year.

What is a Depreciation Schedule?

A depreciation schedule tracks the loss in value of an asset over the life of the asset.

To create a depreciation schedule, you’ll need the following information:

- The original purchase price of the asset

- The depreciation schedule applicable to the asset

- The amount of depreciation taken in prior periods on the asset

- The current period’s depreciation expense

You use depreciation schedules when preparing tax returns or preparing financial statements. Any company with large asset purchases will need to write off the value of the asset over time.

Depreciation applies to purchases such as machines, vehicles, rental properties, office equipment, and furniture.

What are the types of depreciation schedules?

There are several different types of depreciation methods that vary based on the type of asset and the basis of accounting. Generally Accepted Accounting Principles (GAAP) and tax basis accounting often use different depreciation methods.

Declining Balance

The declining balance depreciation method has a higher depreciation expense in the earlier years of the asset’s lifetime. This is because a certain percentage of the current beginning book value of the asset is written off each year. However, the percentage remains the same throughout the lifetime of the asset.

For example, if you purchase a computer for $5,000 with a 20% declining balance depreciation, the first three years of depreciation would be:

| Beginning Book Value | Depreciation (Beginning Book Value * 20%) | Ending Value | |

| Year 1 | $5,000 | $1,000 | $4,000 |

| Year 2 | $4,000 | $800 | $3,200 |

| Year 3 | $3,200 | $640 | $2,560 |

The benefit of the declining balance method is that the depreciation closely aligns with the rapid decline in the value of some assets. However, the drawback is that you will have lower depreciation expenses in the later years of the asset.

You use declining balance depreciation for assets that become outdated quickly, such as computers or cell phones.

Double-Declining

Double-declining balance depreciation is similar to declining balance depreciation, except that the percentage used is double (as the name implies) of the declining balance method.

If we look at the same computer asset from the declining balance example above, the depreciation would be:

| Beginning Book Value | Depreciation (Beginning Book Value * 40%) | Ending Value | |

| Year 1 | $5,000 | $2,000 | $3,000 |

| Year 2 | $3,000 | $1,200 | $1,800 |

| Year 3 | $1,800 | $720 | $1,080 |

The double-declining depreciation method allows for a much more significant expense during the first few years of an asset, but the deduction is much lower in later years.

Use double-declining balance for vehicles that lose a large portion of their value in the first year and lose value slowly in later years.

Sum-of-the-Years’ Digits

The sum-of-the-years’ digit depreciation is the most complicated of the time-based depreciation methods. In this method, you start by calculating the asset’s useful life (i.e., five years), and then you add up the years (in this case, you would add 5 + 4 +3 + 2 + 1 = 15). You then start with the highest number in year one, so the first year’s depreciation would be 5/15 of the total depreciation.

For example, the same asset from our previous examples costing $5,000 with a useful life of five years would have the following depreciation schedule.

| Beginning Book Value | Depreciation | Ending Value | |

| Year 1 | $5,000 | $1,667 (5000 * 5/15) | $3,333 |

| Year 2 | $3,333 | $1,333 (5000 * 4/15) | $2,000 |

| Year 3 | $1,000 | $1,000 (5000 * 3/15) | $1,000 |

The sum-of-the-years digit depreciation method is appropriate when an asset uses up more of its useful value in the first few years. The drawback is that it’s one of the more complicated types of depreciation to calculate.

Units of Production

You use the unit of production depreciation schedule for manufacturing equipment that has an estimated number of units that can be produced. For example, you would take the number of expected units that the machine can produce (i.e., 10,000 units) and calculate the depreciation based on that figure (i.e., each unit would cause 1/10000 of the equipment to be depreciated).

Example: Machinery that can produce 10,000 units and costs $5,000.

| Units Produced | Beginning Book Value | Depreciation | Ending Value | |

| Year 1 | 2,790 | $5,000 | $1,395 (5000 * 2,790/10,000) | $3,605 |

| Year 2 | 1,430 | $3,605 | $715 (5000 * 1430/10000) | $2,890 |

| Year 3 | 4,110 | $2,890 | $2,055 (5000 * 4110/1000) | $835 |

This method matches up the equipment’s production capacity with the machine’s actual use. The drawback is that the estimated capacity of the equipment may be wrong, or you will have a small deduction in years of slower production.

The units of production method is used for machinery and manufacturing equipment.

Straight-Line Method

The straight-line method is the simplest option for calculating depreciation. Furthermore, you calculate the asset’s lifetime and then write off the same amount each year.

Example: Asset with a cost basis of $5,000 and useful life of 5 years.

| Beginning Book Value | Depreciation | Ending Value | |

| Year 1 | $5,000 | $1,000 | $4,000 |

| Year 2 | $4,000 | $1,000 | $3,000 |

| Year 3 | $3,000 | $1,000 | $2,000 |

The benefit of this method is the simplicity of the calculation and the predictable annual expense. However, the drawback is that straight-line depreciation does not often match the asset’s value because most assets depreciate quickly during the early years.

Real estate often uses straight-line depreciation.

What is the Best Depreciation Schedule?

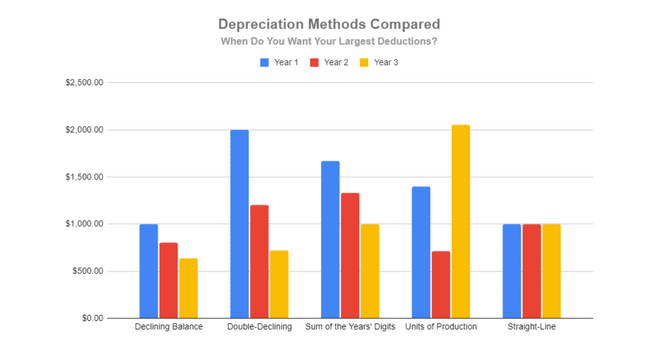

The best depreciation schedule will ultimately depend on your goals and financial situation.

A Quick and Easy Depreciation Schedule

Straight line is the quickest and easiest depreciation method. Therefore, you should use straight line when you’re looking for an easy and simple way to calculate your depreciation expense.

Higher Short-Term Deductions

To get the highest depreciation expense quickly, you may need to calculate the difference between the sum-of-the-years, double declining balance, and units of production methods to see which yields the highest deduction in the early years of an asset.

You would want to get the highest short-term deduction when you want or need higher expenses in the early years of an asset.

Bigger Deductions in the Future

To get more significant deductions in the future, you’ll again want to compare different methods (declining balance or units of production) to see which yields the highest later years’ deductions.

You’d want bigger deductions in future years if you are expecting higher profits during the later years of the asset’s lifetime.

Final Thoughts on Depreciation Schedule Methods

The depreciation method you choose will depend on your financial goals and the type of asset you are purchasing. If you are subject to GAAP or tax accounting rules, the depreciation method is often chosen for you. If you have the opportunity to pick your method, you should consider how quickly the resale value of the asset drops, how long you plan on using the asset, and the timing you want for the depreciation deduction.

A tax advisor can help you decide what depreciation schedule is best for your large business expenses. Contact the tax experts at Shared Economy Tax now to learn more about depreciation methods. For more tax tips on just about everything, subscribe to our newsletter below.