Most people dream of living on unearned income and enjoying the easy life. But the taxation of unearned income is complex, and you’ll need to ensure that you have adequate records.

We’ll look at what is and is not unearned income, the most common types of income, and how to tax and report the income.

What is Unearned Income?

Unearned income is any income that is not the result of active work on the part of the recipient. Interest on savings accounts, dividends from stocks, and rental income are all examples of unearned income. Retirement income, such as pension income and IRA distributions, are also unearned income.

Unearned income can be a valuable component of financial stability, and often taxes at a lower rate than earned income, such as salaries and wages. Long-term capital gains, dividends, and rental income are subject to special rules that can lower the tax rates on these types of income.

All income, whether earned or unearned, must be put on a taxpayer’s return. Therefore, most types of unearned income report to the IRS and the taxpayer on 1099s. The downside is that most types of unearned income will increase the taxpayer’s taxable income.

Another downside of unearned income is the net investment income tax (NIIT). Since 2013, certain high-income taxpayers have been subject to net investment income tax on their unearned income. The NIIT imposes a 3.8% tax on investment income for taxpayers with incomes over $200,000 or $250,000 for couples filing joint tax returns.

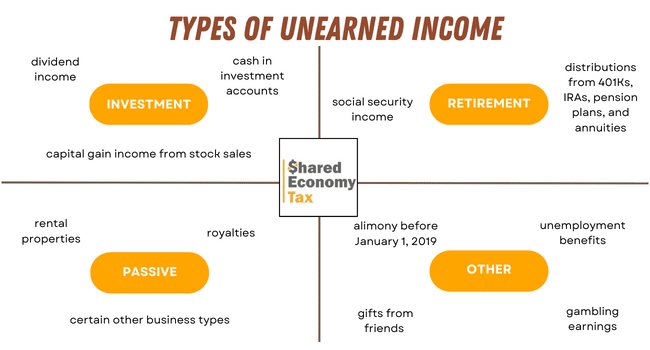

Types of Unearned Income

There are several types of unearned income that you may receive throughout the year.

Investment Income

The Investment income category covers numerous income streams. Any interest derived from checking, savings, and investments qualified as unearned or passive income. At the end of the year, you’ll receive a Form 1099-INT reporting the amount of interest you received.

Investment income also includes dividend income from stocks and mutual funds. Your brokerage reports dividend income on a 1099-div each year.

Investors may also have capital gain income from stock sales. Short-term capital gains happen when you own the assets for less than a year, while long-term capital gains come from assets held for at least a year. Long-term capital gains tax at a lower tax rate than short-term capital gains.

Retirement Income

Retirement income is unearned income. There are several potential sources of retirement income.

Social security benefits are the most common type of retirement income. Social security benefits include both retirement income and disability payments. Only a portion of your social security is taxable. The taxable portion ranges from 0%-85%, which the rest of your income determines.

Other sources of unearned retirement income include distributions from 401Ks, IRAs, pension plans, and annuities. While most of these payments are taxable, distributions from ROTH IRAs are not taxable.

Passive Income

Passive income is unearned income from any activity requiring minimal involvement. For example, rental properties and other businesses often generate unearned, passive income.

For rental properties, the net income from the rental after considering expenses and depreciation is unearned income. However, there are limitations on who can write off rental losses and passive losses from other businesses. Because the rules for passive losses are complex, it’s best to work with a tax professional to determine whether you can write off losses in any given year.

One other common type of passive income is royalties. Royalties are often a result of writing a book, investments in oil and gas, and licensing of your intellectual property.

Other

There are several other types of unearned income. Alimony from agreements before January 1, 2019, is unearned taxable income. Unemployment benefits also qualify as unearned because you didn’t perform any work to receive the benefit.

The IRS also says gambling income is unearned, even though it involves some participation from the recipients.

Gifts from friends and relatives also count as income you haven’t technically earned. However, gift income isn’t subject to taxes, although the giver may need to file a gift tax return depending on their local filing requirements.

How to Track Unearned Income for Businesses

Though most passive income is related to individual returns, businesses also have several sources of unearned income throughout the year.

Gift Cards

Many people have a few unspent gift cards in a drawer somewhere, but rarely consider the effect that the unspent gift card has on a company’s books.

Gift cards sold by businesses result in immediate cash deposits, but don’t create earned income. When a gift card is sold, it creates a short-term liability for the business, since the business will need to provide services equal to the value of the gift card in the future. The income is not recognized until the gift card is used.

To record a gift card on a company’s books, a bookkeeper should record the full value of the gift card as a short-term liability and the payment for the gift card as a deposit to the company’s bank account. When the gift card is spent, the bookkeeper would debit the gift card liability account and credit the company’s income account.

Unused gift cards should be written off over time, since the likelihood of a gift card being redeemed the longer the period of time that has passed since it was issued.

Customer Deposits

A customer deposit is considered unearned business income. A deposit is often refundable up until the business has incurred costs related to the order.

Consider a pool installer that requires a $2,000 deposit to begin scheduling contractors and sourcing supplies. The deposit is refundable until the installer has made payments to contractors or suppliers.

As long as the deposit is refundable, it should be recorded as a liability and not as income. Once the deposit becomes nonrefundable, the deposit would be considered earned income and moved to the P&L.

Future Contract

If a business creates a customer order but does not collect any funds from the customer (like a deposit in the above example), the customer’s order would be unearned income. In this case, the order would increase the business’s accounts receivable and increase the company’s liability accounts.

The income from the work would not be recognized until the work is in progress (or completed, depending on the timeline of the project).

If the customer cancels the order prior to completion, the bookkeeper should reverse the entry since no funds were received and no future work is promised.

Taxes on Unearned or Passive Income

Unearned income differs from earned income, but it still accrues taxes in some form.

Unlike earned income, unearned income is not subject to self-employment taxes. However, self-employment taxes currently total 15.3% of earned income, so the potential tax savings on reporting income as unearned is significant.

Most forms of unearned income are in your adjusted gross income and are subject to income tax rules. Gifts, interest on municipal bonds, and alimony from agreements starting after 2018 are some of the most frequent exclusions from taxable income. Many states have different rules for what unearned income is, in your state’s taxable income.

How to Report

Most income gets reported to the IRS via various tax forms. Your tax return should reflect the same income totals shown on these forms. Here are a few examples of informational tax forms that show reported income:

- Dividends and Distributions: Form 1099-DIV

- Interest Income: Form: 1099-INT

- Miscellaneous Income: Form 1099-MISC

- Retirement: Form 1099-R

- Certain Government Payments, Unemployment, Etc: Form 1099-G

Other types of passive income may not automatically generate a tax form. Nonetheless, you are responsible for reporting it. You should track all unearned and passive income to report on your tax return, including:

- Alimony

- Cash from relatives or friends

- Gambling (under a certain amount)

Unearned / Passive Income Tax Forms

Unearned income is on lines 2 through 8 on your Form 1040. Most of these lines have a and b sections. Section a consists of the total amount of unearned income, while section b only includes the taxable amount of each type of income.

Line 8 is the total of Schedule 1. Schedule 1 includes all other types of income not included on the 1040 lines 1-7. For example, schedule 1 includes rental income, business income, alimony, and unemployment income. Each of these types of income will receive additional forms and details.

Final Thoughts

Unearned income can significantly increase your overall income and your tax bill. Take the time to understand how the IRS taxes your income streams, so you know what to expect at the end of the year.

Passive Income Tax Strategies from Experts

Don’t overpay for your hard-earned, or unearned, income! Shared Economy Tax can help you minimize your tax bill so you can keep more of what’s yours. Contact us today to set up a complimentary one-on-one strategy session with one of our veteran tax pros. And, don’t forget to leave your email below to sign up for our tax tips newsletter!