The two biggest topics for small business and investors this summer have been far and away: tax reform (the One Big Beautiful Bill) and interest rates.

We’re excited about key provisions in the OBBB specifically around expensing development costs and accelerated bonus depreciation. You can read more about OBBB and its implications in our handout linked below.

We are less optimistic when it comes to interest rates.

Interest rates are like gravity in the financial world. You can’t see them, but they pull on everything, the value of your home, the growth rate of your business, and even how we think about investments and risk.

But where we lose the analogy is … gravity doesn’t change; interest rates do. And in this case, interest rates are changing the rules of the game.

Rates are higher than we’ve seen in years, and it’s forcing all of us, homeowners, entrepreneurs, and investors to rethink our assumptions.

Real Estate: The Unshakable Asset Is Shaking

Buy a house, hold onto it, and it’ll build wealth over time. Such was the adage passed down from the silent generation to today. But as boomer investment sage Ray Dalio recently pointed out, that story doesn’t hold up so well in today’s environment.

And here’s why:

- Interest rate sensitivity: Real estate reacts more to interest rates than to inflation. When borrowing costs go up, property values (which should move inversely with interest rates) go stagnant and in some areas, decrease in value.

- Fixed and taxable: Unlike other investments, real estate locks up cash, has higher carrying costs, and is an easy revenue source for governments, which makes it an expensive investment (via taxes) that is locked into a single, undiversified asset class.

- Illiquidity: You can’t pick up a property and move it, nor can you diversify it. Real estate and your cash is stuck in place, and that makes your money less flexible.

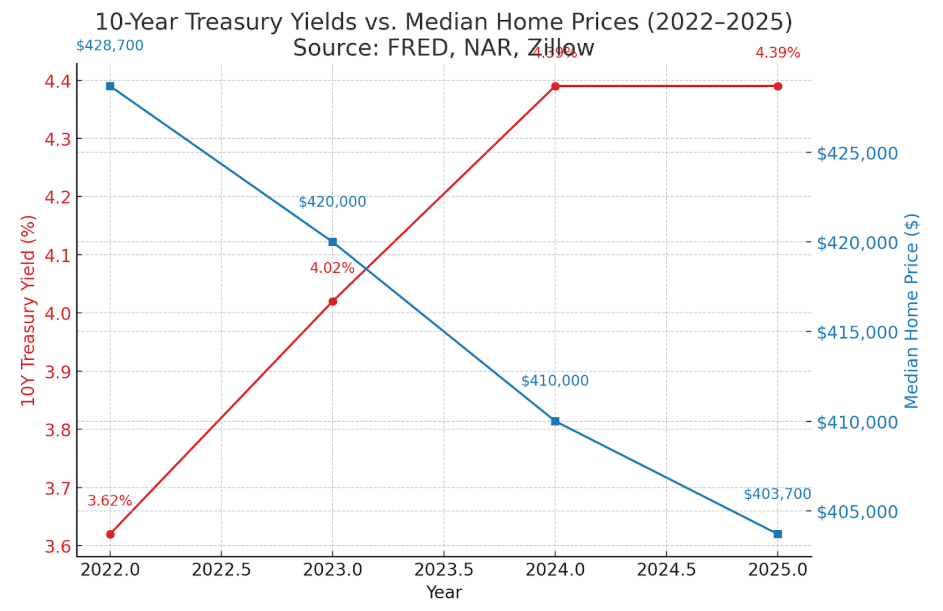

Take, for example, the following graph showing interest rates and the median home price over the last three-year period. Still confident that real estate only goes up? What used to feel like a “sure thing” suddenly feels less certain in an environment where interest rates are on the move. Notice in particular, that even while interest rates held steady, the median home price has continued to DROP.

The punchline: every day sellers have taken longer to adjust price down (and continue to do so) and buyers are less willing to purchase in an uncertain interest-rate environment.

The Ripple Effect of Higher Rates

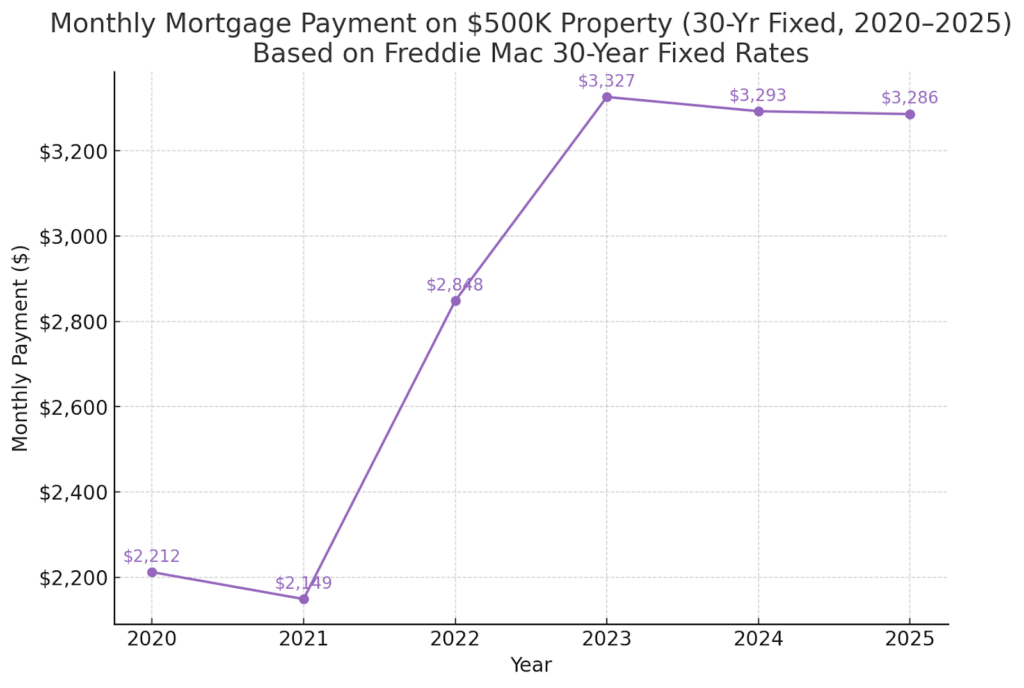

That interest rates impact affordability is not news. Consider the following mortgage payment on a $500K home (we’re not even talking second home or vacation rental rates).

In 2020, that payment would have been $2,212 per month. Today, that same property would mortgage out at $3,286, or about 1.5X. That’s ignoring rising home insurance premiums and property taxes.

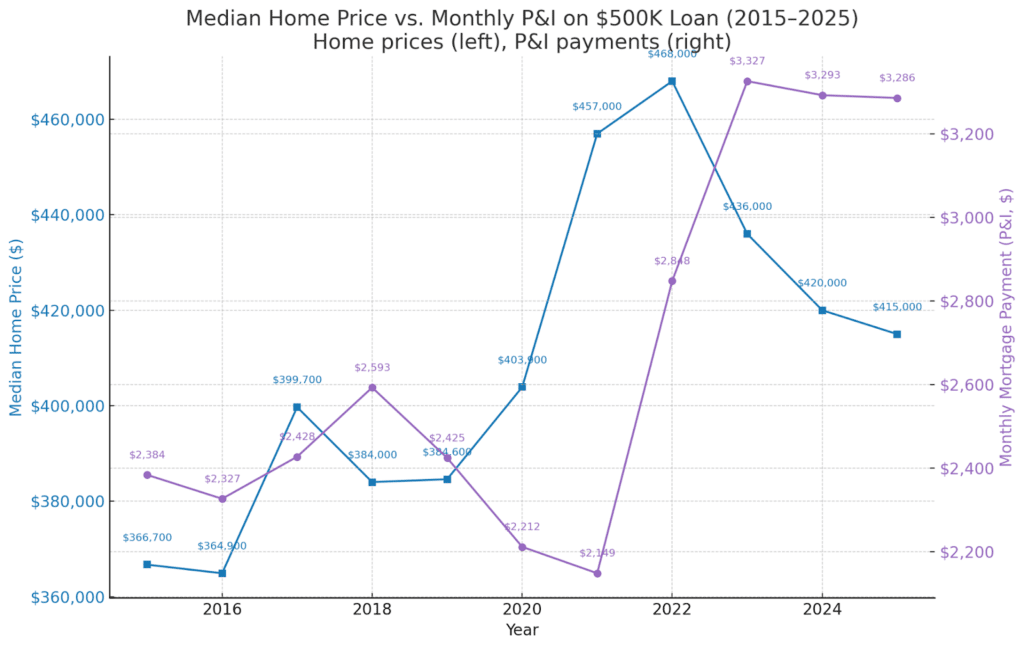

Skeptical observers would be right to point out that 2020 rates were historically low. During the 2015-2019 era, what I’d call the Trump I period, rates were significantly higher, closer to 4.0% (which is where we returned in 2023), with an average mortgage payment of $2,450/mo.

However, and very importantly, asset prices were nowhere near current prices. That same $425,000 home in today’s dollars, in 2018 (at the peak of pre-Covid interest rates) was $384,000.

To illustrate that, you just need to see the past ten-year period, which we’ve included below.

The punchline is not surprising: the best year to buy was 2020 and the worst was some period between 2022 and 2023.

The reason, however, isn’t interest rates, not directly. It’s the asset price. Buyers and sellers were so used to high asset prices that they couldn’t imagine selling for less than what was listed on Zillow. Sound familiar?

I experienced it firsthand.

(Almost) Buyer’s Remorse

In 2020, looking to expand our office space in Austin, I went under contract on a $1.2 million commercial office. The last time it sold in 2010, it went for under $500K. Trying to get interest rates while they were low and a good SBA 7(a) loan, I pushed through the process. Because SBA takes its sweet time (requesting everything from blood type to your first born), I knew to negotiate for a 120 day close.

And I’m so glad I did. During the process the 7(a) interest rates went from 4.8% to 8.6%, every few days it seemed to go up 100 bps to my horror. Seeing the writing on the wall and the increasing monthly principal and interest (which went from $5-6K/mo to $10-12K/mo) on the deal sheet, I asked the seller to drop the price to $1.0 million, to make the payment manageable.

I understood the risk, we were under contract after all. They were partners who previously occupied the building (before moving their team to fully remote) for 10+ years and were looking to cash in on historic appreciation (and 1031 the deal). The comps had made them salivate. Why should they take a price cut? I was crazy for not expecting the same appreciation.

Not me. I had one question for them, who is going to pay 2020 prices at 2022 interest rates? I still remember that call, I was at my father-in-law’s office in San Francisco. His office on Market Street overlooks the TransAmerica building and I remember looking out at it and all the other beautiful (empty) office space wondering if I was crazy for trying to enter commercial real estate in the first place, or crazy for pulling out of the deal.

I lost the earnest money ($13K) which still hurts me to this day and is hard to write about. But I saved myself from tying up a significant amount of my wealth in an asset that would be depreciating month over month. By this point, I’d be under water, by how much, I don’t know.

Instead, I made the difficult choice to move to a sub lease, moved our meeting space to Wework where part of our team met twice a week, and created a new budget for flying and connecting at conferences. As far as the numbers go even with travel and lodgings costs, EBITDA went up. Cutting $7K/mo in rent will do that.

And while we’ve had to redefine how to work in a 100% remote environment, we’re learning every day how to do it better. We connect intentionally, set up hyper focused on-site agendas with training, attend events where our peers and prospects are to grow the business, have gotten to travel the world (yes, we’ve been to Asia and Mexico just in the last year), and have had epic long dinners. And it all came from interest rates.

So, Where Do We Go From Here?

Higher rates aren’t the end of opportunity. They’re a reminder that the playbook needs updating.

- For business owners, it might mean getting more creative about financing and how you operate.

- For investors, it might mean diversifying beyond traditional “safe bets” or having a strategy to park cash in equities until asset prices are right sized.

- For homeowners, it might mean patience or creativity in finding an off-market or different-region home.

The investors who thrive in this environment won’t be the ones clinging to yesterday’s expectations. It takes one to be adaptive and importantly, flexible and open to changing data. It’s not the end of the world.

Final Thought

Interest rates may feel like gravity is getting heavier, but here’s also the truth: gravity doesn’t stop rockets. Even in this environment, there are good deals, just don’t operate with the norm of expectations and assumptions. And as interest rates are rumored to drop, remember too that asset prices will also move, albeit slowly up. The key is to time it right.

One Big Beautiful Bill Act

On July 4, President Trump signed the One Big Beautiful Bill Act into law. In this email, we’ve included a brief overview of selected provisions from the BBB that may impact your business including accelerating depreciation of business assets and expense treatment for research and development expenses.

👉 Get our complete summary PDF here.