Retirement account contributions can provide substantial tax benefits while you work towards retirement. For independent contracts, SEP IRAs and Solo 401(k)’s are two of the most popular options. Both options provide many of the same benefits, but there are a few key differences that set them apart from one another. In this guide, I’ll compare Solo 401(k) vs SEP IRA so you will know the best option for your circumstances.

What is a Self-Employed 401(k)?

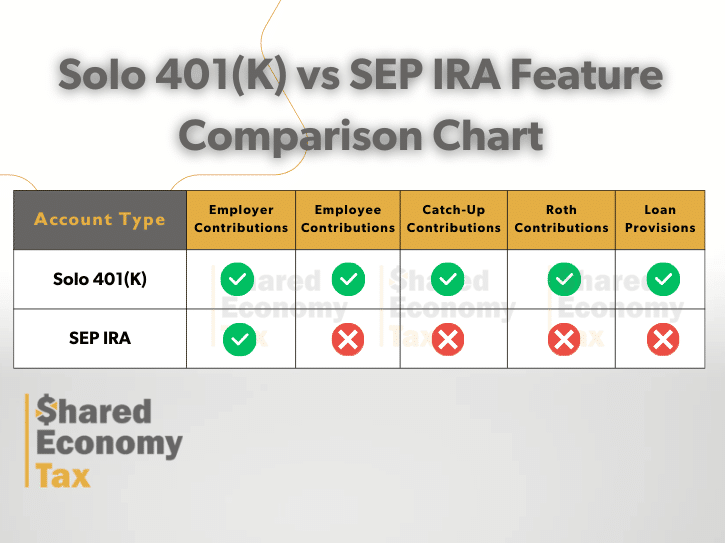

A Self-Employed 401(k), also referred to as a Solo 401(k), is a retirement plan that helps self-employed individuals create a plan with benefits similar to those of traditional 401(k) plans. The unique structure of this retirement plan allows solo entrepreneurs to contribute more money, as they can contribute as an employer and employee. Solo entrepreneurs who participate in this plan can choose a traditional 401(k) plan or a Roth 401(k).

This plan only works for solo entrepreneurs or married couples who do not have any employees. Smaller companies that have employees are not eligible to participate in this plan. The contribution limits for Solo 401(k) plans typically increase slightly every year. The combined contribution limit for 2024 is $69,000, up from $66,000 in 2023.

What is a SEP IRA?

A SEP IRA is a type of retirement plan that smaller companies can use to share their profits with employees through an employer-sponsored retirement plan. The contribution is based on a % of the company’s net income, but there is also an annual contribution limit. A SEP IRA allows a company to set aside 25% of its net income, up to $69,000 annually, for its employees.

This plan is better for small business owners who have employees and want to offer them 401(k) benefits. This plan can be used as a tool for companies to offer stronger benefits to their employees and help connect them to the company’s financial growth.

If a company chooses to create this plan, they can’t just offer the benefits to themselves and need to include all eligible employees. However, companies can exclude some participants, such as part-time employees, employees under the age of 21, and employees who have not worked for the company in the past three or five years.

It is very easy for companies to set up this retirement account, and the benefits of this account can grow over time as a business becomes more successful.

Self-Employed 401(k) vs SEP IRA: Contribution Limits

One of the benefits for self-employed individuals is that they can take advantage of both of these plans, which can maximize their tax savings. The contribution limit for these plans is $69,000/year, but it may be lower for the SEP IRA if 25% of a company’s income is equivalent to an amount lower than $69,000. If you plan to use both plans, you need to make this clear when you file taxes and ensure the combined amount does not exceed the limit.

Many types of traditional retirement plans allow older individuals to contribute more money to make up for previous years. These Self-employed 401(k) and SEP IRA accounts also offer similar benefits for individuals who are 50 years old or older. Individuals who are over the age of 50 may be able to contribute $73,5000 in 2024.

Comparing Tax Benefits

Self-employed 401(k) plans have many types of benefits for participants. Contributions to this plan are tax deductible, which can reduce your total taxable income. You can also grow your investments without paying taxes until you take disbursements, and you can also take tax-free withdrawals early on part of your account if you have a Roth IRA. For most self-employed people, it makes sense to participate in this plan and enjoy some of the same tax benefits as corporate employees who have an employee-sponsored 401(k) plan.

Small businesses, with a handful of employees, may benefit from offering a SEP IRA. investments in these accounts can also grow tax-free, and participants only have to worry about taxes once they retire and start taking disbursements. Small businesses can also lower their company’s income taxes, as SEP IRA contributions can be deducted as a business expense. This profit-sharing model may motivate employees to stay with the company too, which can make SEP IRAs a great tool for companies to recruit and retain employees.

Administrative and Set-Up Complexity

Once you have decided that these retirement plans could be a good fit for your business, the final two steps are to choose a plan and handle all of the ongoing administrative work.

If you want to set up a Self-Employed 401(k) you will need an employer identification number, which you can obtain from the IRS, and then find the brokerage that you want to use. The deadline for a contribution is typically by the end of the year. You will also need to complete Form 5500, which is an annual requirement if you have more than $250,000 in assets in your retirement account.

One of the benefits of a SEP IRA account is that you do not have to worry about annual filing requirements. However, you are still subject to IRS requirements and need to report this activity on your tax return. SEP IRAs are also very easy to set up and do not require as much ongoing administrative work, but you still may need a tax professional to ensure that you are filing correctly.

Flexibility and Contribution Frequency

Solo 401(k) accounts have a lot of flexibility in terms of the contribution amount. Self-employed individuals can begin by contributing up to $23,000 as an employee and then an additional 25% compensation as the employer. In total, this plan may allow for aggregate contributions up to $69,000 or $76,500 if you are older than 50.

SEP IRA contributions vary greatly based on the company’s profitability until it hits the ceiling of the annual limit, which is $69,000 in 2024. This can be a benefit for companies, who are only required to pay a certain amount based on profitability and can pay less during less successful years. Employees should keep these factors in mind, as the SEP IRA contributions may not be consistent.

Which Plan is Better for Your Business?

Solo entrepreneurs who are earning a lot of money and want to contribute a lot of funds to the account may prefer the self-employed 401(k) option due to the high annual limits. On the other hand, a smaller business with several employees may prefer a SEP IRA, due to the easy filing requirements and flexibility in the payment amounts, which adjust in line with the company’s profitability.

Either way, both small businesses and solo entrepreneurs should take advantage of these plans, as they can offer tax savings and allow them to grow their investments faster.

Closing Thoughts on Self-Employed 401K vs SEP IRA

Both Self-Employed 401(k) and SEP IRA plans offer numerous benefits for solo entrepreneurs and small business owners who want to provide themselves and/or employees with retirement benefits.

Running a business comes with financial stress and uncertainty, but building up a nest egg through a Solo 401(k) or SEP IRA can provide additional financial security.

Shared Economy Tax specializes in strategic tax planning for self-employed individuals looking to slash their tax bill. Get started now with a one-on-one strategy session with on of our tax pros to see how, much you can save.