When someone dies, their estate (defined as all the assets they own) becomes subject to the estate tax. The federal estate tax only applies to estates over $11.7 million, so very few people need to worry about the federal estate tax.

However, most of the estate over $11.7 million is taxed at 40%. So it is vital to understand the implications if your estate is anywhere near the $11.7 million figure.

What Is Estate Tax?

Estate tax is a tax on the transfer of property after someone dies. The government imposes taxes on the estate’s total value, defined as the fair market value of all assets minus any debts and liabilities. To generate revenue, the federal government created the estate tax in 1916. Today, it is one of the largest sources of income for the government, bringing in about $20 billion per year.

Who Pays Estate Tax?

The estate of the deceased person pays the estate tax. In order to get the total value of the estate, we combine the total assets of the estate. The estate must pay all due taxes before distributing the assets to the beneficiaries.

Are Estate Taxes Federal or Local?

Most estates are only subject to federal estate taxes. Federal estate taxes can be up to 40% of the estate’s value.

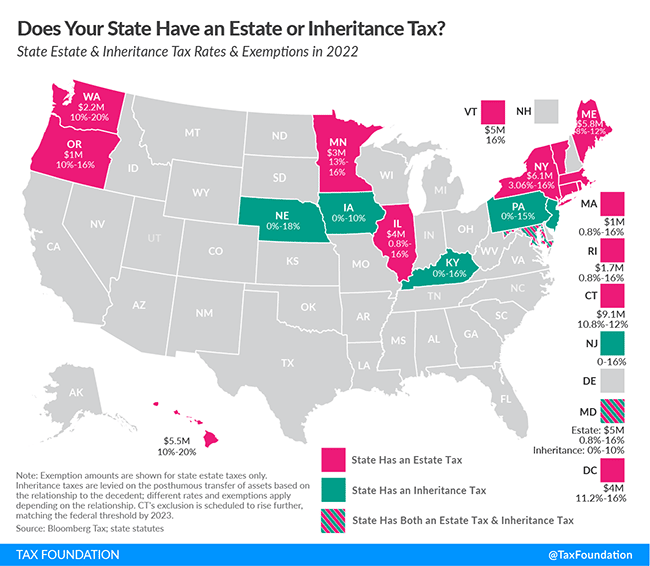

Twelve additional states and the District of Columbia also charge estate taxes on their residents. The rules vary significantly by state, including the number of assets subject to taxation and the tax rate charge. The rates range from 0.8% up to 20% depending on the state, and some states impose taxes on estates as small as $1 million.

What Assets Are Subject to Estate Taxes?

Each person has a lifetime exemption of $12.06 million (as of 2022). Once that exemption has been used up, either through gifts during the person’s lifetime or having an estate larger than that figure, the remaining amount will be subject to estate tax. The exemption figure is subject to change each year without notice.

Estate Taxes vs. Inheritance Taxes

While the deceased person’s estate pays the estate tax, the recipient pays an inheritance tax. Currently, there is no federal inheritance tax.

Though there is no federal inheritance tax, six states impose an inheritance tax on their residents.

Estate Tax Planning and Strategies

Estate tax planning is something that everyone should consider, regardless of the size of their estate. You also must keep a close watch, especially because of the uncertainty regarding future changes to the lifetime exemption amount.

Tips for Minimizing Estate Taxes

There are several ways to minimize estate taxes, and with careful planning, it is possible to reduce the amount of taxes owed significantly.

Gift Assets While You are Still Alive

You should make use of gift tax exclusions to lower the taxable amount of your estate. Every year, you can give up to a certain amount of money to an individual without incurring any gift tax.

This exclusion amount changes from year to year, so it’s important to stay up to date on the latest figures. For 2022, the limit is $16,000 for every recipient. For example, a married couple could give $32,000 to each of their children.

Use a Life Insurance Policy to Cover Taxes on an Estate

Life insurance is included in the total value of your estate.

If your spouse is the beneficiary, then the proceeds are not taxable, since you do not pay estate taxes when your assets are passed on to your spouse when you pass away.

If the payouts go to your other beneficiaries, then the value will become part of the estate. However, the premiums you paid for the insurance are less than the payout to the insurance company, so the estate can use the additional money to pay your estate taxes.

Use a Trust

Consider setting up a trust. A trust can help to manage your assets and distribute them according to your wishes while minimizing estate taxes.

Any assets you give to an irrevocable trust will skip your estate and not be part of the estate’s total value. An irrevocable trust means you cannot remove the assets from the trust once they move to it. By transferring assets into an irrevocable trust, you are using up your lifetime exemption, but if you move the assets before they appreciate, you will be using up less of your lifetime exemption than if you wait to transfer the assets when you pass away.

Other types of trust commonly used in estate planning include life insurance and charitable trusts.

Life insurance trusts become the owner of your life insurance policy so that the life insurance proceeds will be excluded from your estate when you die.

Charitable trusts hold assets you intend to give to charity when you pass away. You receive the income from the assets while you are alive, and then assets transfer to your designated charity when you pass away. The assets held by a charitable trust do not calculate as part of the value of your estate.

Use a Family Limited Partnership or Foundation

A family limited partnership (FLP) (or family foundation) pools assets from family members to run a business. In theory, the value of the partnership is in proportion to the assets owned by the partnership and would not shield any assets from the estate.

However, because minority interests are valued at a discount, parents can gift small portions of these partnerships to their children at less than the proportional net asset value. Therefore, a tax professional should assist you in properly structuring these entities and documenting the transfer of ownership interest.

Estate Taxes: Closing Thoughts

Once your net worth is in the millions, you should consider estate planning to minimize the impact of the estate tax. By planning years in advance, you can shield more of your assets through proper tax planning and maximize the amounts your heirs receive.

The tax professionals at Shared Economy Tax have been working with clients for years to minimize their estate tax burden and can walk you through the process of setting up your estate to minimize taxes. Contact us today for a complimentary one-on-one session to discuss your needs with our pros.