Did you receive a CP2000 notice from the IRS? If so, don’t ignore it. Usually, the letters warn you about discrepancies between your reported earnings and IRS records. The CP2000 notice isn’t as bad as an audit, but don’t take it lightly. CP2000 is serious business and if you don’t respond, you could face harsh penalties. You can avoid penalties as long as you play your cards right. If you received one of these letters, don’t panic. Here’s what you need to do.

What Is a CP2000 Notice?

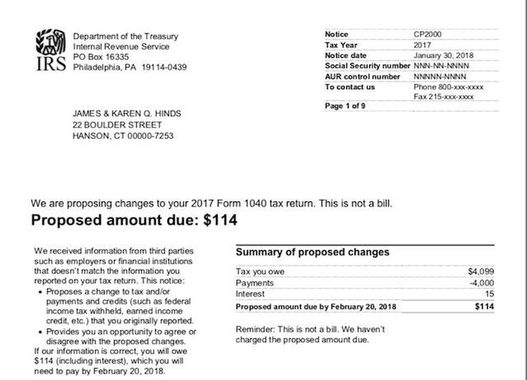

The IRS sends CP2000 notices to inform taxpayers if their reported earnings don’t match government records. Discrepancies can occur for a variety of reasons, but the most common cause is mismatched tax documents. The IRS typically assesses additional taxes to cover the higher total, so you could end up with a higher tax bill.

Airbnb reports your earnings to the IRS too, so the government already knows how much you made. Intentionally underreporting your earnings could cost you big, so don’t mess around. The best way to avoid problems is to report your earnings accurately.

You Received a CP2000; Now What?

Even if you have no additional tax obligation for your Airbnb transaction, you still cannot ignore your notice. The IRS will assess taxes, penalties and interest on your unreported income. Unfortunately, the government says you’re guilty unless you can prove them wrong. Sometimes, these forms result from clerical errors, so you can get out of the extra taxes with proper documentation. For example, maybe the government can’t match that line item on your return, so you just need to verify your numbers. They also don’t know how many days you rented the home, so you have to provide documentation if you fall under the 15-day rule.

If you happen to receive a letter from the IRS, first determine what issues are being addressed. If they say you didn’t report income, you should get in contact with them or even file an amended return to address the discrepancy. You have 30 days to respond from the date of the letter, so don’t go by when you actually received it. Contact the IRS immediately and explain your situation to minimize potential damages.

Staying Out of Trouble

This is a great example of why accurate record-keeping is so important. Make sure you report your income correctly so you don’t have to deal with these issues. If it’s an honest mistake, just present your evidence and try to work it out with the IRS as best you can.

If all of this seems too daunting, we can help. Oftentimes, these cases are mistakes and there are no additional taxes due. However, the hard part is proving your case. Luckily, our experts can help you address the situation and defend yourself. We will do everything in our power to resolve the issue and keep the IRS at bay.

Get Tax Help Now

A CP2000 notice is intimidating, but we’re here to help. Our team of tax pros is standing by to assist you with all of your Airbnb tax needs. If you received a notice, don’t waste time. Contact Shared Economy Tax today and schedule a one-on-one strategy session so we can help you address the issue. Act quickly or the IRS could intensify its efforts. You can also sign up for our complimentary tax tips newsletter using the form below.