The tax code is complicated and confusing for many taxpayers. To make matters worse, the law is constantly changing, so it’s next to impossible for most business owners to keep up-to-date. It’s no wonder that many people have difficulty with tax preparation. Unfortunately, you can’t avoid it unless you want the IRS to come knocking. Most people just want to pay their taxes correctly and on time, but there are lots of ways to save if you know what to look for. The answers to these common questions can help you get the best deal.

Basic Tax Questions You Should Be Asking your Preparer

Uncertainty brings forth lots of tax questions, and it’s important to get accurate answers. Taxes directly affect your financial well being, so you should take the time to learn about common tax strategies. Tax professionals eat, sleep, and breathe taxes, so they’re the right people to ask. Professional advisors spend countless hours studying the tax code so they can usually address pressing tax issues. However, you’re responsible for asking the right questions, so you should have a solid grasp of the tax rules that affect your business. You should ask your tax advisory questions like these in order to ensure you’re getting the best deal.

Should I Take The Standard Deduction or Itemize?

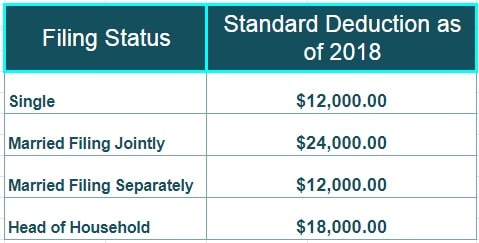

The decision to take the standard deduction vs. itemizing your deductions will depend on your personal situation. Standard deductions were recently raised as part of the Tax Cuts and Jobs Act, making the standard deduction more appealing but also making the threshold for electing the itemized deduction more difficult since you need more itemized deductions to “beat” the standard deduction that is a ‘freebie’ deduction. Single filers can claim a standard deduction of $12,000, and head-of-household filers receive $18,000. Married taxpayers qualify for a $24,000 standard deduction. On the other hand, itemized deductions include actual expenses and deductions. If your itemized total exceeds the standard deduction, you should claim the itemized total because it amounts to more savings. Conversely, you should claim the standard deduction if your itemized total is smaller.

Do I Need To Pay Taxes On All Income?

Yes, the IRS wants it cut of every dollar you earn. Freelancers and self-employed workers will probably receive 1099 forms from their clients. Sharing Economy entrepreneurs could receive 1099K forms, but most platforms only issue them if you earn $20,000 and complete over 200 transactions within the tax year. You must report this income to avoid costly IRS penalties and interest. To ensure that you are able to meet your tax obligations, you should set aside 20-30% of your income in a tax savings account.

If you expect to owe more than $1,000 in taxes, you’re required to make quarterly tax payments. You don’t have an employer, so no one is withholding social security and medicare taxes from your check. Therefore, you are responsible for sending these payments to the IRS. Quarterly payments are due four times a year: April 15, June 15, Sept. 15, and Jan. 15.

Exemptions, Deductions, and Credits

This is a really common tax question. Most people know these are different types of tax write-offs, but each one works differently. For example, exemptions and deductions both work to lower your taxable income. Exemptions take into account your filing status (filing single or jointly) and the number of dependents (spouse or children) you can claim. Deductions represent expenses you incur throughout the year. Some common deductions include business expenses like rent on your office space, operating costs like electricity, insurance, travel expenses, and professional fees.

Tax credits reduce your tax bill dollar for dollar. So if you receive a $1,000 tax credit, you will owe a $1,000 less. Some examples of tax credits include child care, retirement account contributions, or the R&D tax credit for innovation and developing new technology and procedures.

Reducing Audit Risk

An audit can be a scary thing, which is why most taxpayers would prefer to avoid one. The best advice we can offer it to always file on time, file the correct forms, file accurate tax returns, and always be honest. If you are reporting all of your income and paying the correct amount, you should have nothing to worry about. Some audit triggers include:

Deduct Responsibly

Being too liberal with your deductions can also wind you up in the hot seat. Deductions are a great thing, but being excessive and stretching the truth when it comes to deductions is a huge no-no. Utilize deductions that are applicable to your business.

Report ALL Earnings

The IRS wants all income reported, even the income you earned on the side. If you are earning 1099 income, you must report it, and the total must match the figures reported by Form 1099. For example, you share your car on GetAround and you make over 20K on more than 200 transactions. GetAround sends a 1099K form, and they send a second copy to the IRS. That’s why it’s important to make sure your numbers are accurate.

Again, we cannot stress enough how important it is to maintain good records. This way if the IRS has any questions, you have a paper trail to provide them. Working with a tax professional is a great way to ward off an audit, and in the event of an audit can provide valuable insight and guidance.

Should I Hire A Tax Professional?

Hiring a tax professional is always a smart choice. Especially if you have a complicated tax situation. Do you own your own business? Did you receive multiple streams of income during the tax year? Do you conduct business in other states? These are just some of the scenarios that can get a little complicated.

A tax advisor is educated in the tax code, which saves you time from learning it. And since they do taxes for a living, they are also more efficient at it, plus the peace of mind you get is well worth the cost. In addition, a tax advisor can be a lot more than just a tax preparer. They can help you strategize throughout the year so that you are in the best possible situation when it comes to tax season. They can assist with financial planning, business planning, help yous stay compliant, and even streamline your accounting process.

Do you have tax questions? All you have to do is ask! Contact one of the tax experts at The Shared Economy Accounting Group today! To learn more subscribe to our newsletter.